UAE's Klaim Secures $26 Million in Series A Funding for Accelerating Insurance Claim Payments Within the Healthcare Sector

UAE-Based Healthcare Fintech Startup Klaim Raises $26 Million to Improve Insurance Claim Payments

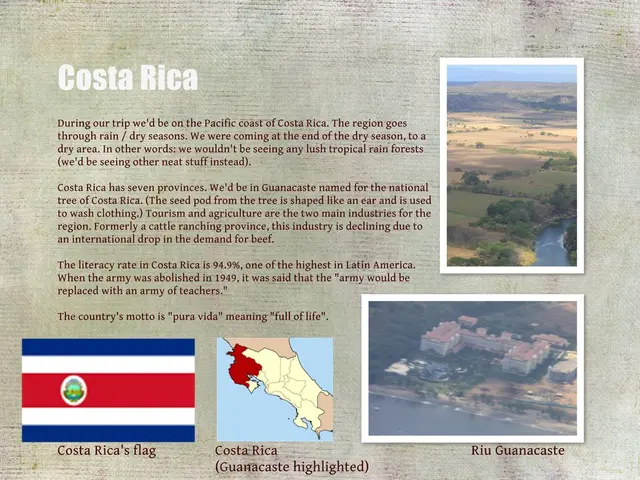

Klaim, a healthcare fintech startup based in the UAE, has secured $26 million in Series A funding to accelerate medical insurance claim payments and improve cash flow stability in the MENA region.

Founded in 2019 by Karim Dakki and Ghafoor Ahmad, Klaim focuses on addressing a critical challenge in healthcare finance by enabling healthcare providers to access payments within 24 hours of claim submission. This is in contrast to the current industry standard, where insurers can take up to 120 days to pay 90% of submitted claims.

The funding round was led by Saudi-based Mad'a Investment, with CDG Invest, the investment arm of Morocco’s Deposit and Management Fund, also participating. The expansion of Klaim's services comes through a collaboration with Tharawat Tuwaiq Financial Company, based in Saudi Arabia.

Klaim's services are currently used by clinics and hospitals across the UAE and the Gulf Cooperation Council (GCC) countries, which include Saudi Arabia, Kuwait, Bahrain, Qatar, and Oman. With the fresh capital, Klaim plans to expand its operations across the MENA region, with a particular focus on deepening its presence in the UAE and deploying capital in Saudi Arabia and Oman.

The MENA region is characterized by fragmented claims processing, and Klaim's fintech approach targets these markets to enhance operational resilience in healthcare finance within these countries. While regulations require claims to be paid within 45 days after submission, the typical payment cycle takes 60-90 days. Klaim's services aim to bridge this gap and provide a more efficient and timely solution for healthcare providers.

At present, there are no explicit details that Klaim is expanding into North Africa or other MENA subregions outside the GCC. However, given its funding milestone and regional engagement, Klaim’s focus countries for growth are the UAE and the broader GCC region.

In summary, Klaim’s expansion focus is on UAE and GCC countries within MENA. The Series A funding ($26M in 2025) is to enhance its healthcare insurance claim payout fintech services regionally. While no clear indication of expansion into non-GCC MENA countries or North Africa yet, Klaim's services are poised to make a significant impact on the healthcare finance landscape in the MENA region.

[1] Source: TechCrunch (https://techcrunch.com/2025/03/15/klaim-raises-26m-to-accelerate-medical-insurance-claim-payments-in-the-mena-region/)

[2] Source: Arabian Business (https://www.arabianbusiness.com/companies/412144-klaim-raises-26m-to-accelerate-medical-insurance-claim-payments-in-the-mena-region)

The Series A funding of $26 million will aid Klaim, a UAE-based fintech startup, in boosting its services within the business sector of the MENA region, specifically focusing on accelerating medical insurance claim payments and enhancing cash flow stability. With the expansion of its services through collaborations like Tharawat Tuwaiq Financial Company in Saudi Arabia, Klaim aims to leverage technology to improve operational resilience and efficiency in healthcare finance.