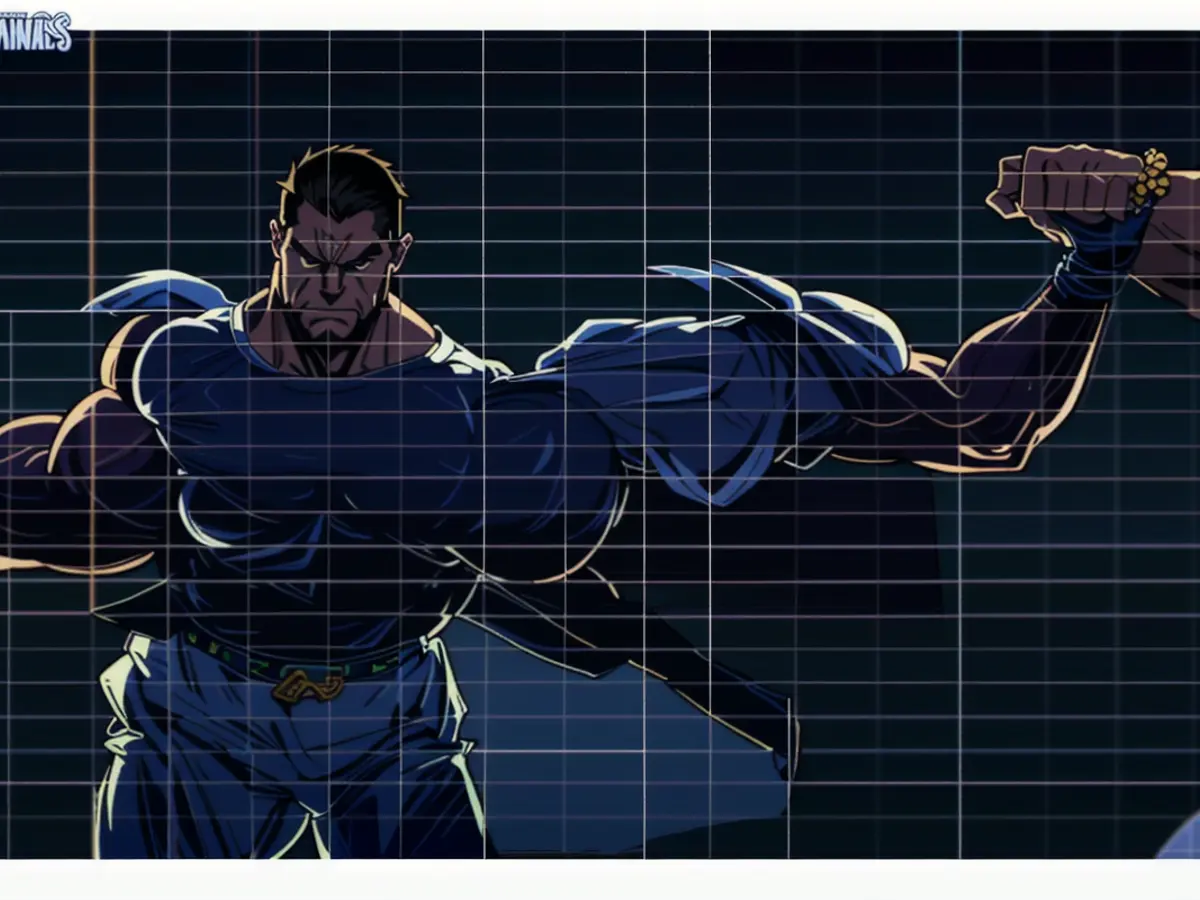

Trump's Value Drops by 14% as Bitcoin Prices Slip Under $96K (Weekend Overview)

Crash and Burn: Bitcoin Dips Briefly, Altcoins Suffer

The recent slump on Friday knocked down bitcoin to $95,700, marking a temporary drop from its sky-high $98,000 peak reached the day before. Don't fret, Bitcoin fans, as this temporary decline seems to have no impact on the digital gold's hot streak.

Most altcoins aren't doing too hot, either. SUI, a notable contender, has seen a 5% dip, pushing its price down to $3.2.

The BTC Rollercoaster Ride

Bitcoin's performance has been nothing if not unpredictable. It soared past $90,000 last week and kept climbing until it reached a local peak of $96,000 on April 25. The digital asset then entered a range-bound consolidation for a week, fluctuating between $93,000 and $95,000.

This period ended with multiple attempts to breach the lower boundary, but BTC held steady. The latest attempt took place on Wednesday, and the cryptocurrency responded by breaking above the upper boundary. This boosted BTC to $97,500 on Thursday and $98,000 on Friday, its highest price in over two months.

Small daily corrections brought BTC back below $96,000 on Saturday. Its market cap currently stands at $1.9 trillion on CoinGecko, while its dominance over altcoins stands firm at 61.7%.

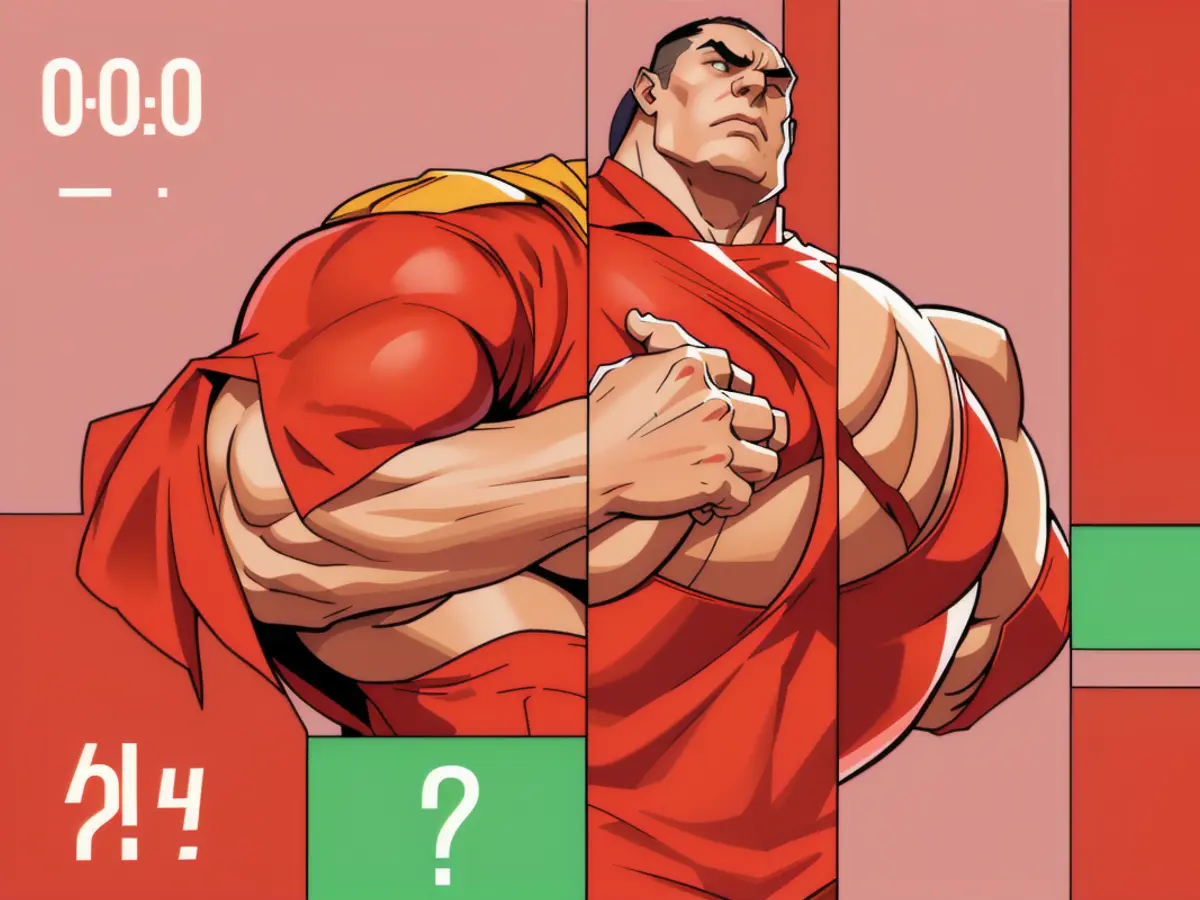

TRUMP's Fall from Grace

Most altcoins are taking a hit today, with XRP, BNB, SOL, DOGE, ADA, TRX, and LINK seeing price drops of up to 3%. SUI and AVAX are leading the downward trend with 5.6% and 4.2% declines, respectively. Consequently, SUI fell to $3.22, while AVAX struggles to stay above the $20 mark.

TRUMP has plummeted yet again in the past 24 hours, losing approximately 14% of its value. Controversy surrounding the project intensified after a dinner invitation that you can check out here.

As a result of these losses, the overall cryptocurrency market cap has dropped by around $25 billion since yesterday, currently standing at $3.075 trillion on CoinGecko.

Get Ahead of the Game:

Want to stay ahead of the crypto game? Start receiving our free, daily market updates to keep you in the loop on all price action in the bustling cryptocurrency markets.

If you're interested in getting started with trading, take advantage of exclusive offers on Binance and Bybit:

- Binance Free $600: Sign up through this link to open a new account and receive a $600 welcome bonus! Details

- Bybit Limited Offer for our website readers: Register using this link to open a free $500 position on any coin! Cryptocurrency details

- Cryptocurrency charts | Facebook | Twitter | LinkedIn | Telegram

Enrichment Data:

- The current momentum for Bitcoin (BTC) is considered bullish, with institutional interest and price recoveries driving the digital currency.

- Despite recent corrections, BTC still has potential for further growth, with analysts forecasting averages higher than $90,000 for the rest of 2025, and some expecting it to surpass $136,000 in the mid-term.

- Other major cryptocurrencies like Ethereum, XRP, Binance Coin, Solana, Dogecoin, Cardano, and Chainlink generally follow BTC's market movements, but their prices can be more volatile due to project-specific factors and regulatory news.

- Bitcoin's latest recovery and institutional inflows may be contributing to a positive outlook for altcoins as well, despite their increased volatility.

- The turbulence in the crypto market is evident, with Bitcoin (BTC) experiencing a temporary dip to $95,700 after soaring past $90,000, while most altcoins, including XRP, BNB, SOL, DOGE, ADA, TRX, and LINK, are seeing price drops of up to 3%.

- The unpredictable nature of the BTC market is evidenced by its recent rise to a local peak of $96,000 on April 25, followed by a consolidation period and a break above the upper boundary to reach $98,000, only to correct and trade below $96,000 again.

- The blockchain technology continues to influence the crypto market, with analysts predicting that Bitcoin will average over $90,000 for the rest of 2021 and potentially surpass $136,000 in the mid-term. Altcoins, despite their increased volatility, may also benefit from Bitcoin's recovery and institutional inflows.