Palladium Price Surges on High Demand, Limited Supply

Palladium, a rare and lustrous metal, has surged in price due to high demand and limited supply. The automotive industry drives this demand, particularly for its use in catalytic converters. Russia and Africa, together accounting for about 75-80% of the world's production, are the primary suppliers.

Palladium, discovered in 1803, is part of the platinum group metals (PGMs). Its primary use is in catalytic converters for gasoline-powered vehicles, accounting for over 80% of its demand. This helps reduce air pollution, making it a crucial component in efforts to combat climate change.

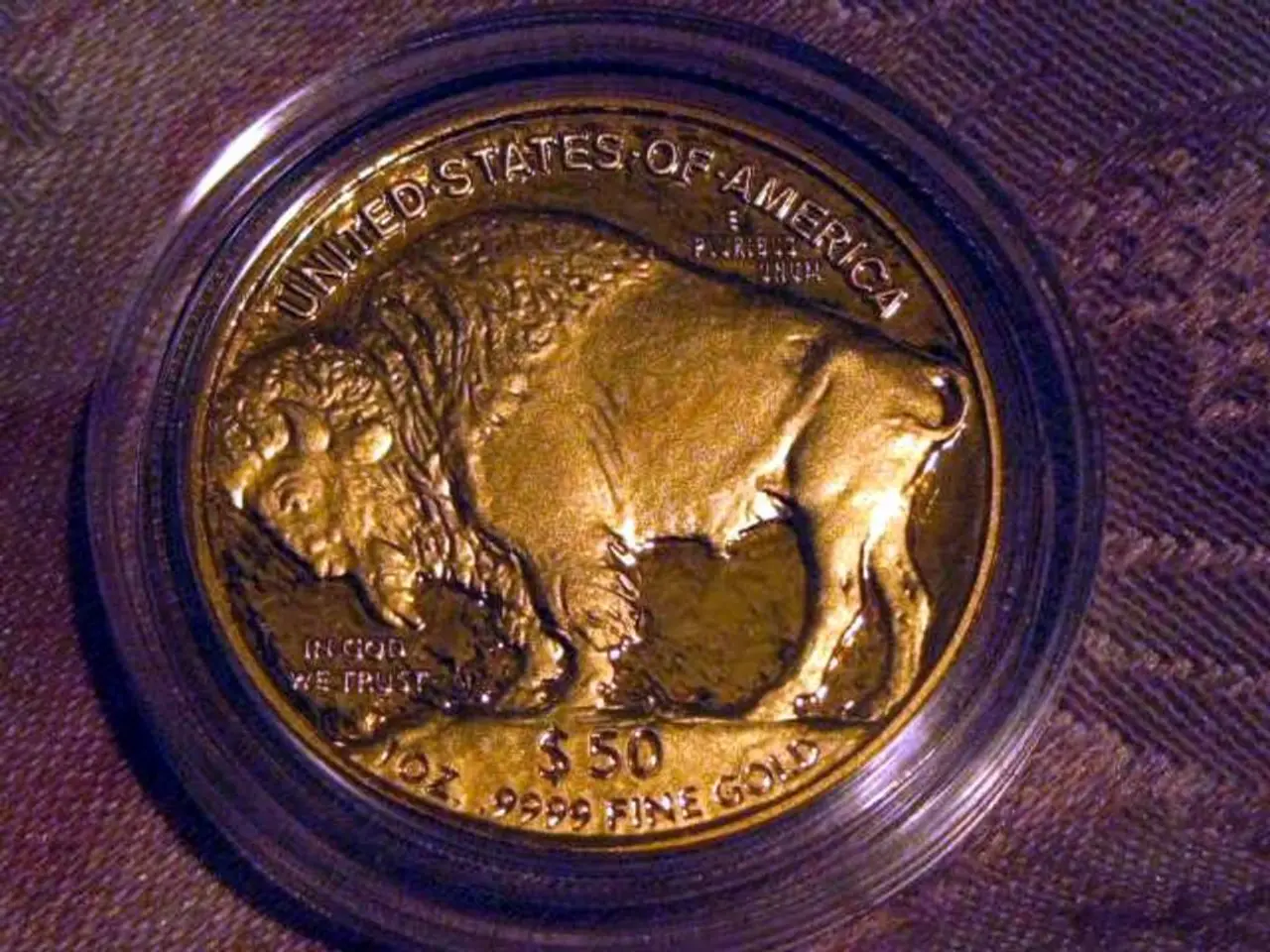

Investors have taken notice of palladium's soaring demand and constrained supply. Its price has surpassed gold, making it an attractive asset. Investors can gain exposure to palladium through bars, coins, or exchange-traded funds (ETFs). Other uses of palladium include jewelry, electronics, and dentistry.

Palladium's primary sources are mining operations in countries like Russia and Africa. Its high price is driven by strong demand from the automotive industry and a very limited, geographically concentrated supply. As demand continues to grow, particularly in the automotive sector, palladium's role in a low-carbon future is set to increase.

Read also:

- Transforming Digital Inventories in the Food Industry: A Comprehensive Guide for Food Businesses

- Munich Airport Unveils Its New Electrical Vehicle Charging Parksite

- Vehicle electrification and bidirectional charging technologies could potentially reduce EU energy expenses by a staggering €22 billion annually by the year 2040.

- Rapid Construction of Rajasthan's 435 Megawatt Solar Power Plant in Eight Months Reduces Carbon Dioxide Emissions by Over 700,000 Tons