Finality unveils marking for tokenized transactions; £20 million funding revealed

Fnality, a pioneering fintech company, is working on the development of its dollar-denominated settlement system. However, as of mid-2025, specific details about its current operational status or launch timeline have not been explicitly detailed in the available search results.

The initiative aligns with global efforts to revolutionize cross-border payments by providing near-instant, atomic settlement using blockchain technology. Fnality's ambitions for cross-border payments are consistent with the broader industry drive towards integrated, finality-driven payment networks that reduce risk and latency compared to traditional systems.

John Whelan, Managing Director of Digital Assets at Banco Santander, has highlighted Fnality's earmarking feature as a key element that helps enable atomicity in institutional blockchain-based applications. This feature adds to the 24/7 instant payments previously showcased for margin payments, FX swaps, and repo transactions.

Three banks - Goldman Sachs, BNP Paribas, and DTCC - were the first to go live on the sterling Fnality payment system (£FnPS). The banks involved in developing the programmable functionality for Fnality include Lloyds Bank, Santander, and UBS. Fnality is also backed by 20 of the world's largest global financial institutions.

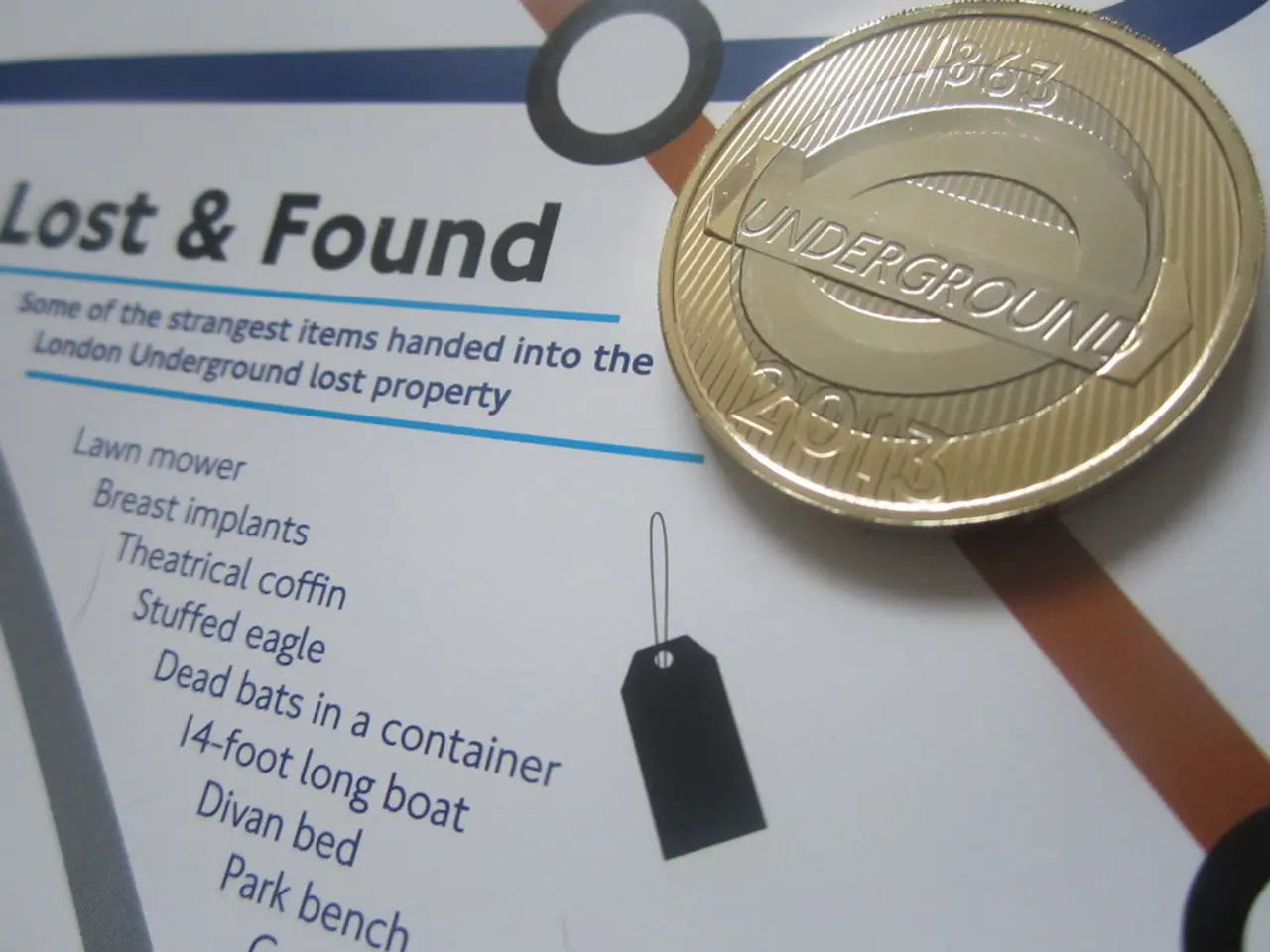

Notably, Fnality International has announced the earmarking of funds as its latest feature for tokenized central bank reserves. This feature is expected to enhance the efficiency of cross-border payments further.

Regulatory conditions in the U.S. around stablecoins and digital payments, including anti-money laundering (AML) controls, are evolving in ways that will likely impact Fnality’s rollout and functionality. The U.S. Treasury and regulatory bodies are actively shaping the landscape, establishing clear rules for payment stablecoins and digital assets.

In terms of funding, Fnality raised a £50 million Series A in 2019 and a £77.7m Series B in 2023. Fnality International disclosed a £20 million convertible loan note issued on 30 September 2024. The convertible loan note will convert to equity upon completion of Series C funding, which is currently in progress. However, it's worth noting that Fnality did not earn any revenue in 2024, and as of year-end, it had almost £34 million in cash on hand.

In summary, while the exact timeline and operational details of Fnality's USD settlement system are yet to be announced, the company's work is a significant step towards improving cross-border payments and reducing settlement risk, particularly involving central bank digital currencies (CBDCs) and stablecoins. The regulatory landscape in the U.S. is shaping to accommodate such innovations, making Fnality's progress a key indicator of the future of digital finance.

- Fnality's USD settlement system, utilizing blockchain technology, aligns with the broader industry's vision of revolutionizing cross-border payments by providing near-instant, atomic settlement.

- The technological advancements in the banking and finance industry, including Fnality's earmarking feature and programmable functionality, are helping reduce risk and latency compared to traditional systems.

- The integrated blockchain-based applications developed by Fnality, such as the sterling Fnality payment system (£FnPS), are backed by 20 global financial institutions, thereby highlighting the industry's interest in this technology.