Solana Swiftly Addresses Unlimited Token Minting Vulnerability, Sparks Debate

Ethereum community voices concerns over perceived centralization following Solana's resolution of major flaw

In the middle of April, Solana [SOL] swiftly fixed a vulnerability that could have allowed an attacker to drain or mint unlimited tokens under the radar.

The Solana Foundation made the update public on 3 May (two weeks later), for security reasons, as attackers would have exploited these loopholes had it been shared immediately. However, the update sparked a heated debate rather than accolades, particularly from its rival Ethereum's [ETH] camp.

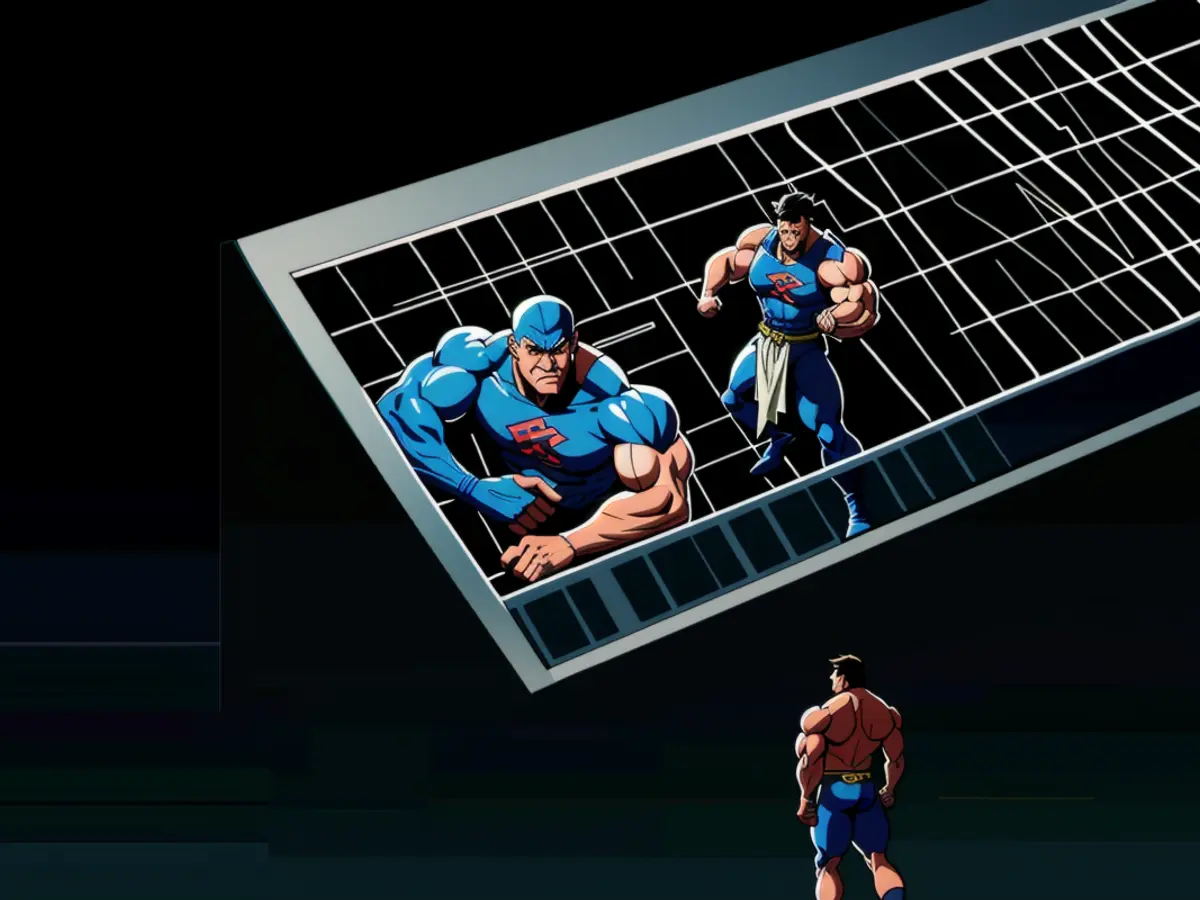

The Solana-Ethereum Faceoff

Ryan Berckmans, an Ethereum community member, criticized the Solana team for "centralization." He pointed out a lack of diverse production clients (execution software) as his primary concern. Berckmans asserted,

According to Berckmans, this meant zero-day bugs (like the one fixed) on the client were "de facto protocol bugs."

Solana, for its part, uses two validator clients (software for running nodes). Firedancer is the latest. The other live execution client is the Agave client, although there are others under development. On the contrary, Ethereum boasts four live execution clients, which reduces the risk of a single point of network failure or attack.

In response, Solana co-founder Anatoly Yakovenko stated,

Market Sentiment and Price Prediction

At the time of writing, SOL's market sentiment was neutral, leaving its price direction uncertain for the week ahead. A shift towards "fear" territory could suggest a discounted buying opportunity if others panic, as per the Solana greed and fear index.

On the price charts, SOL gave back part of its recovery gains from mid-April, down nearly 10% from a recent $157 high to trade at $143. This pullback could represent a buying opportunity if it doesn't breach the short-term moving averages at $141 or $132. However, a sustained drop below the averages might indicate a bearish trend, with a further dip to the $120-zone a possibility.

Insights:

- Ethereum's Security: Ethereum benefits from a larger and more diverse group of stakeholders and developers, which enhances its security. The decentralized nature of Ethereum contributes to its robustness and resilience against attacks[3].

- Solana's Security Concerns: Solana, on the other hand, lacks a slashing mechanism in its staking model. This absence has raised concerns regarding the economic security of its network, as validators face less risk for violating rules[3]. Despite this, Solana's high-performance architecture and innovative consensus algorithms like Proof of History remain attractive for certain applications.

- Investment Appeal: Ethereum remains the gold standard for security and high-value DeFi applications, which makes it attractive to institutional investors seeking robustness and decentralization. Solana's appeal lies in its high transaction speed and cost efficiency, which are crucial for applications requiring real-time performance[2][4].

- The Solana-Ethereum debate continues, with Ethereum's Ryan Berckmans criticizing Solana's centralization due to a lack of diverse production clients, claiming that zero-day bugs on Solana's client are "de facto protocol bugs."

- In response, Solana co-founder Anatoly Yakovenko points out the presence of two validator clients in Solana's network and suggests that Ethereum's reliance on a majority of Lido validators might pose a similar risk.

- Despite Solana's quick fix of an unlimited token minting vulnerability, market sentiment towards Solana remains neutral, making its price direction uncertain for the week ahead.

- Meanwhile, the broader crypto market, including coins such as Ethereum, Bitcoin, Dogecoin, and various tokens, continues to evolve, with technology playing a significant role in driving innovation and shaping market dynamics.