ETF Market Store: NaroIQ, a Platform for Exchange-Traded Fund Purchases

NaroIQ: A Digital Platform Revolutionizing the ETF Market

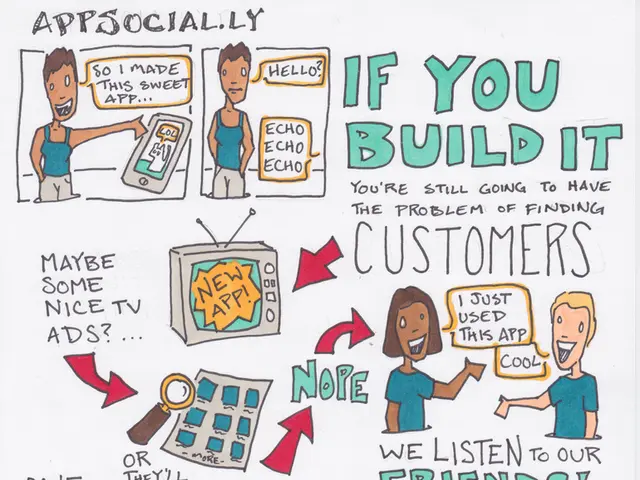

NaroIQ, a Cologne-based startup, is set to make waves in the European ETF market with its innovative business model. Positioned as a 'Shopify for the ETF market', NaroIQ offers a digital platform that empowers institutional providers like banks, insurance companies, and asset managers to launch their own ETFs and fund products efficiently and cost-effectively [1][3][4].

Since its inception in 2022, NaroIQ has undergone a significant transformation from a B2C approach to a B2B business model. The company's primary focus is on providing a scalable technological infrastructure tailored for digital ETF and fund operations, aiming to modernize Europe's ETF and fund infrastructure [1][3][4].

The platform's key features include digital-native launch capabilities, cost efficiency, modern technologies, and rapid product rollout within the digital ecosystem. These features are designed to lower market entry barriers for providers, enabling them to launch ETFs and funds quickly and cost-efficiently [1][3][4].

NaroIQ's business model revolves around providing SaaS-like infrastructure and tools, enabling fund providers to operate ETFs more flexibly and economically. This approach is similar to how Shopify empowers merchants to build online stores without heavy upfront tech investment [1][3][4].

The company has recently secured an investment of 5.85 million euros from Berlin-based investors Magnetic and Redstone, and American venture capitalist General Catalyst, bringing the total investment in NaroIQ to around 9 million euros [2]. This funding will be used to continuously develop and scale the platform.

NaroIQ's team, currently consisting of 20 employees, is planning the market launch and the launch of their first partners in the second half of this year. The idea for NaroIQ came about due to the growing popularity of ETFs and the need for companies to have access to the market.

Cologne, with its vibrant startup scene, strong investor landscape, and numerous coworking spaces, trade fairs, and networking events, offers an ideal environment for startups like NaroIQ to thrive. The city is relatively far from the bustle of Berlin, yet it boasts fast connections to major cities like Frankfurt, Luxembourg, Amsterdam, and Paris [5].

For founders in Cologne, CologneBusiness serves as a central point of contact, promoting the framework conditions for startups, networking them with investors, and offering targeted support [6]. The CologneBusiness initiative can be found on LinkedIn, Facebook, and Instagram.

In addition to its digital focus, NaroIQ also leverages AI for automating internal product and company processes [7]. The company's long-term goals include further developing its regulatory capabilities and expanding its product offerings.

With a focus on concreteness and moving beyond just talk, NaroIQ plans to have tangible results to show by the end of the year, marking a significant step forward in its mission to revolutionize the ETF market [8].

[1] https://www.naroiq.com/ [2] https://techcrunch.com/2023/03/15/naroiq-raises-5-85-million-to-build-a-shopify-for-the-etf-market/ [3] https://www.businessinsider.com/naroiq-etf-marketplace-raises-funding-to-help-companies-launch-etfs [4] https://www.finextra.com/blogposting/21616/naroiq-raises-5-85-million-to-build-a-shopify-for-the-etf-market [5] https://www.cologne-business.de/en/start-up/ [6] https://www.cologne-business.de/en/start-up/ [7] https://www.naroiq.com/ [8] https://techcrunch.com/2023/03/15/naroiq-raises-5-85-million-to-build-a-shopify-for-the-etf-market/

Investing in technology is crucial for NaroIQ as it strives to modernize the European ETF and fund infrastructure, providing digital-native launch capabilities and cost efficiency to institutional providers. By leveraging AI for automating internal processes, NaroIQ aims to make the ETF market more accessible to businesses.