CMC Markets, headed by Lord Cruddas, acquires control of a blockchain company

A New Leap in Digital Finance: CMC Markets Upgrades Stake in StrikeX Technologies

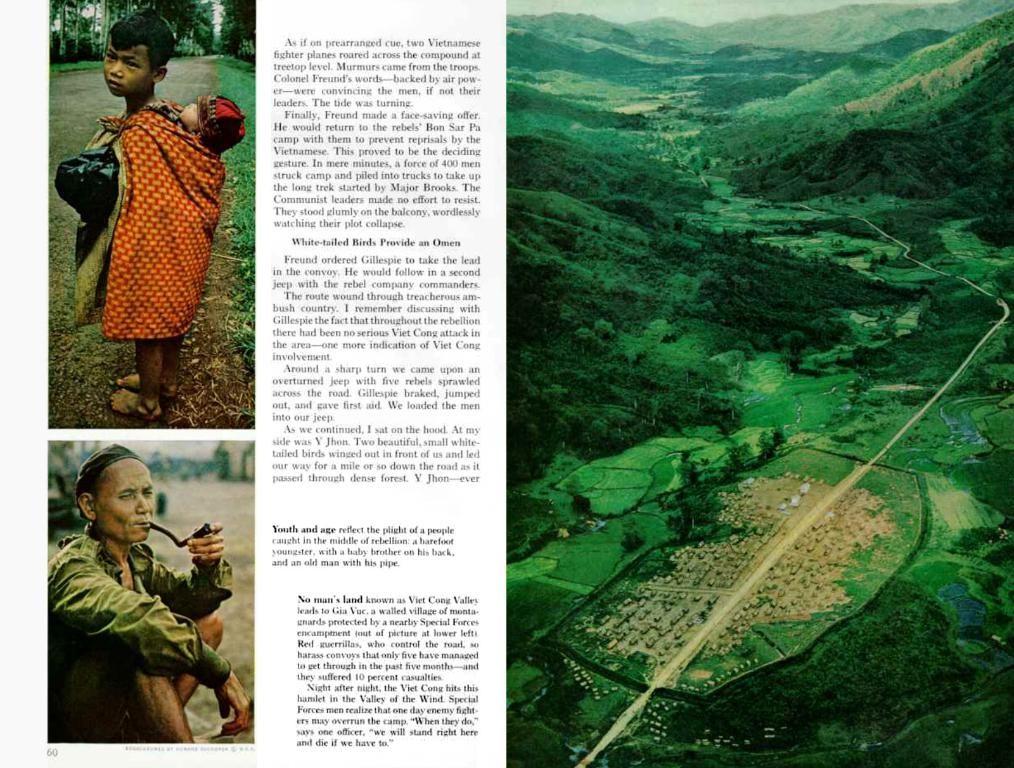

London-based trading firm, CMC Markets, led by Conservative Peer Lord Peter Cruddas, has stepped up its game in the blockchain sector. On a Wednesday announcement, the company revealed it has boosted its hold in StrikeX Technologies to a majority 51% stake, up from a previous 33%.

This significant investment grants CMC Markets a stronger foothold in StrikeX, accelerating the development, regulatory approvals, and global distribution of its products. CMC Markets also expanded its collection of STRX cryptocurrency tokens from 10 million to 15 million, as part of the deal.

In turn, CMC Markets gains immediate access to StrikeX's blockchain technology, Web3 infrastructure, and tokenized asset solutions. It's all about accelerating product roll-out and expanding digital solutions for broader audiences, as the company asserted.

Lord Cruddas shared his enthusiasm, stating, "This majority acquisition represents a significant leap forward in our ambition to lead in digital assets. We are building a future-ready platform to deliver regulated, institutional-grade access to tokenized assets, blockchain-powered solutions, and the next generation of financial services."

Established by Cruddas in 1989 as a foreign exchange market called Currency Management Corporation, CMC Markets made its debut on the London Stock Exchange in 2016, priced at 240p per share with a valuation of £691m. The company weathered a "Cash for Access" scandal in 2012, which took a toll on its revenue. But, Cruddas later emerged victorious in a libel case against The Sunday Times, winning back public trust.

Today, CMC Markets continues to focus on innovation and diversification, investing strategically to expand its capabilities across the digital finance ecosystem. With StrikeX Technologies on board, the future looks bright for this blockchain and Web3-focused firm.

- CMC Markets' significant investment in StrikeX Technologies' blockchain sector products is expected to accelerate their development and global distribution.

- The expansion of CMC Markets' collection of STRX cryptocurrency tokens to 15 million is part of the deal with StrikeX Technologies.

- With the majority 51% stake in StrikeX Technologies, CMC Markets gains immediate access to its blockchain technology, Web3 infrastructure, and tokenized asset solutions.

- Lord Cruddas envisions the majority acquisition as a significant leap forward in CMC Markets' ambition to lead in digital assets, aiming to deliver a future-ready platform for institutional-grade access to tokenized assets and blockchain-powered solutions.

- Post the legal victory in a libel case against The Sunday Times, CMC Markets, established in 1989 as a foreign exchange market called Currency Management Corporation, continues to focus on innovation and diversification in the digital finance ecosystem.