Brown University Jumps into Crypto ETF Game with $4.9M Investment

Blackrock Secures $4.9 Million from Brown University for its Bitcoin ETF

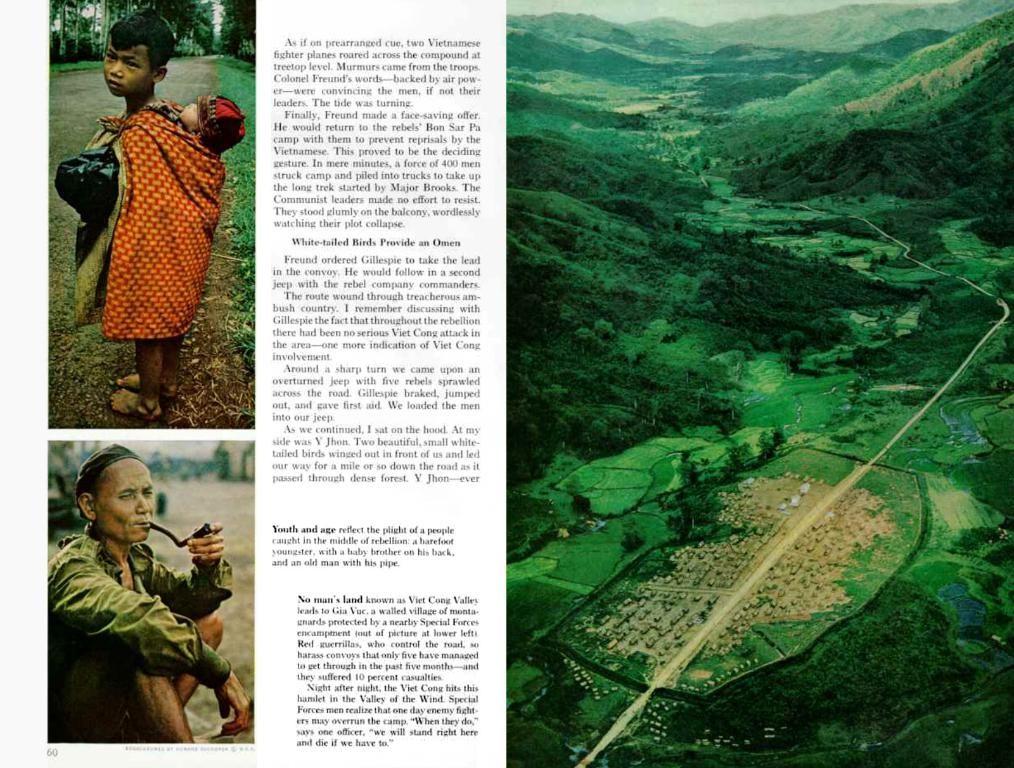

In a bold move, Brown University has dived headfirst into the crypto ETF space, splashing out a cool $4.9 million on BlackRock's iShares Bitcoin Trust (IBIT)—as evident from SEC disclosure documents. This innovative investment represents Brown's first Quarter 2025 move, accounting for 2.3% of its $216 million equity portfolio.

Much like a schoolyard trend catching fire, this decision by Brown University is being emulated by many established institutions, all eager to tap into digital assets through approved investment channels. Investors ranging from hedge funds, pension funds, and university endowments have found solace in Spot Bitcoin ETFs like IBIT, thriving as their go-to Bitcoin investment solution.

The SEC-approved IBIT, an institutional investment goldmine, has seen a meteoric rise in appeal over the past months, as Bitcoin's price tracker Mar '24. In less than a year, IBIT has soared to become one of the leading ever-performing ETFs. As of March 31, 2024, IBIT held a whopping 576,000 BTC, translating to total assets worth a staggering $47.78 billion.

Brown's hefty investment portfolio, worth a grand $7 billion, netted a jaw-dropping 11.3% return in '24. Notably, this allocation to a Bitcoin ETF suggests a potential paradigm shift in their investment strategy.

Institutional investments have been adopting Bitcoin ETFs like fish to water, moving their Bitcoin investments through traditional financial avenues. By hopping on the IBIT spot ETFs bandwagon, institutions reap Bitcoin's growth potential without the hassle of managing Bitcoin tokens directly.

Ready to dive deeper into the world of Bitcoin ETFs? Check out: Bitcoin ETFs Amass $1B Inflow in 4 Days As BTC Builds Momentum

What's next for Bitcoin ETFs?

- Institutional interest in cryptocurrencies is skyrocketing as digital assets gain traction as a hedge against inflation and a means to diversify portfolios with alternative assets.

- Improved market infrastructure and enhanced custody solutions for digital assets have made investing via Bitcoin ETFs more palatable for institutional investors.

- BlackRock's iShares Bitcoin Trust (IBIT) has been instrumental in attracting institutional inflows into Bitcoin, its success resulting in Bitcoin's recent price surge.

- Up to $3 billion in inflows into US-based Bitcoin ETFs are projected for Q2 2025, emphasizing Bitcoin's role in institutional portfolios.

- Regulatory clarity, new custody solutions, and improved exchanges have contributed significantly to maturing the Bitcoin markets and facilitating institutional participation.

[1] Infrastructure improvements fuel the rise of institutional Bitcoin investments

[2] Growing institutional interest in Bitcoin hints at its maturing market

[3] BlackRock's IBIT leads the charge in institutional Bitcoin adoption

[4] Bitcoin as a hedge: A gold-rush for portfolio diversification

[5] The future of Bitcoin ETFs: Expect $3B in new inflows by Q2 2025

- Brown University's $4.9 million investment in BlackRock's iShares Bitcoin Trust (IBIT) demonstrates the increasing interest of institutions in cryptocurrencies, such as Bitcoin, as a hedge against inflation and a means to diversify portfolio holdings.

- The improving market infrastructure and enhanced custody solutions for digital assets, like IBIT, have made it more appealing for institutions to invest in Bitcoin ETFs, thereby facilitating their participation in the maturing Bitcoin markets.

- The success of BlackRock's iShares Bitcoin Trust (IBIT) has been significant in attracting institutional inflows into Bitcoin, leading to a notable increase in Bitcoin's price.

- As institutional investors continue to seek ways to diversify their holdings, Bitcoin ETFs such as IBIT are expected to witness up to $3 billion in inflows by Q2 2025, further emphasizing Bitcoin's role in institutional portfolios.

- Regulatory clarity, novel custody solutions, and advanced exchanges have all contributed to the maturation of the Bitcoin markets and increased institutional participation in Bitcoin ETFs like IBIT.